CIBIL: How to check your credit score without a PAN card

Today, it is very important to keep track of your credit score as it not only reflects your creditworthiness but also affects your ability to secure loans and favourable interest rates. Now, what should we do if many people still need PAN cards? Let us know how you can do this without a PAN card.

Checking your credit score without a PAN card

To check your credit score without a PAN card, follow these steps:

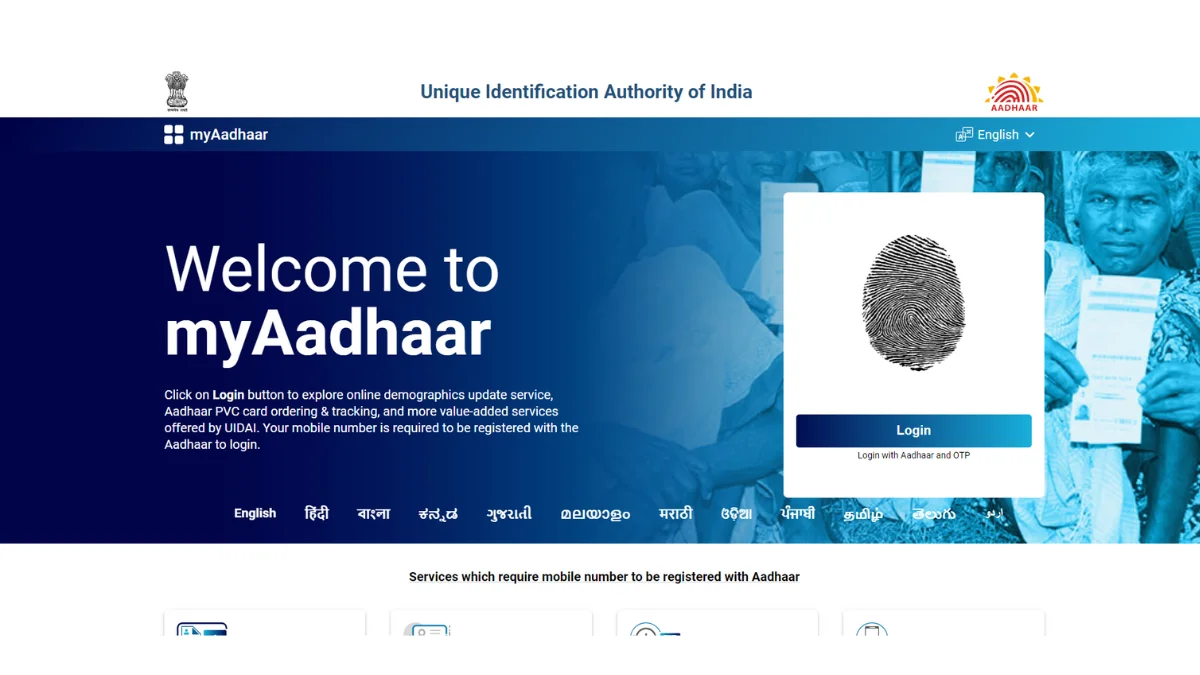

Step 1: Visit the official CIBIL website:

*Visit the official CIBIL website.

*then select “Get your free CIBIL score” after selecting “Personal CIBIL Score.

Step 2: Create an Account:

– You must first create an account here with your email ID.

Step 3: Optional Identity Document:

You can now use alternate identification papers, such as a driver’s license, passport, or voter ID, in place of your PAN card.

Enter your entire name, birth date, pin code, and state of residence.

Step 4: Mobile Verification:

– Enter your mobile number and click “Accept and Continue”.

– An OTP on your mobile phone; enter it on the next screen to verify your identity.

Step 5: Access Your Credit Score:

– Once verified, you will get access to your credit score.

If your CIBIL score has deteriorated, then these are some tips:

Ways to Improve Your CIBIL Score

- Making Payment on Time:

- Not paying your outstanding loan on time can badly affect your credit score, so remember to pay on time.

- Check for deficiencies in your credit report:

- Check your credit record and correct any mistakes you may have made.

- Try to maintain a good credit balance: Pay secured and unsecured loans on time.

- Do not carry dues: So that your credit score increases, clear all credit card dues.

conclusion

Even without a PAN card, you can remain informed about your creditworthiness. Monitor your score regularly and take active steps to improve it.