EPFO interest: EPFO has now announced the interest rate for provident fund deposits for the financial year 2023-24 in February 2024, and now EPFO has increased its interest rate to 8. The tax has been increased from 5% to 8.5%.

Now, those who have EPF accounts are waiting to see when the PE interest will arrive in their account.

But let us tell you that EPFO has said that the amount will soon start appearing in your account.

EPFO Interest Rate

The new interest rate for FY24 is 8.25%.

How to check EPF balance?

There are many ways to check EPF balance:

Umang App: Download the Umang App from the Play Store on your mobile. Then open the app and create your account, or if you are already registered, log in directly. Go to the EPFO section to check your balance.

EPFO Portal: Open EPFO’s official website on Google and log in using your Universal Account Number (UAN). Your remaining details will be there.

Missed Call Service: Now, make a missed call to 011-22901406 from the mobile number linked to your EPFO. You will receive an SMS regarding your balance.

SMS Service: Send an SMS with the message “EPF HO UAN ENG” to 7738299899.

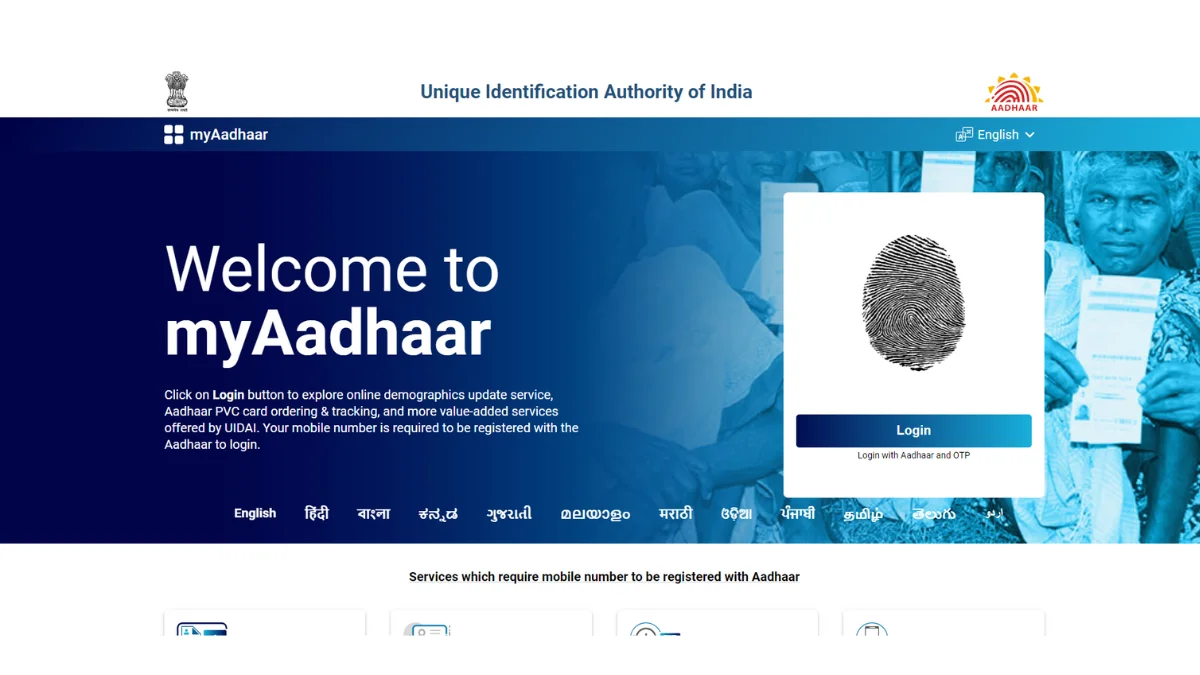

EPF KYC Update

Once you have done the EPF, check whether your KYC is updated with the EPF account. This involves linking your Aadhaar, PAN and bank account details. If not, then do this work first.

EPF Withdrawal Process

If you want to withdraw your EPF amount, then these are some steps:

1. Login to the EPFO portal.

2. then Go to the Online Services section and select “Claims (Form-31, 19 & 10C)”.

3. after that Fill in the required details and submit your withdrawal request.

4. EPFO will process your request, and the amount will be credited to your bank account.

What is EPFO?

Now, new people need to learn what EPFO is. A provident fund means if you go to someone, some portion is deducted as a provident fund; this is Meghnad; there are two types here: one is employer contribution, and the other is employer contribution. Contribution There is a minimum here that there are some people who deduct only the minimum provident fund, but if you see that the cent of contribution in a provident fund is 25 and 65 cents in the country, i.e. the amount of your salary is coming. Out of that, it was 2%. Let’s see, if we talk about the company, then this total amount is C because point 258 is your employer’s contribution, too. Your company is putting in your provident fund, so that money is only coming to you. Whatever we have in both the provident funds, we get tax exemption on it. Here, the interest rate is also very good; we get one point five per cent interest here because there is a tax exemption.

Eligibility for EPFO

If you work in establishments with 20 or more employees, all employees are eligible for EPF. This includes employees from both private and public sectors.

New rules of EPFO

What are the new rules of EPFO? From April 1, the Employees Provident Fund Organization, i.e. EPFO, introduced important changes. With the new rule, when a person changes jobs, his old provident fund, i.e. PF balance, will be automatically transferred to the new appointee. The need for account holders to manually request PF transfers upon joining the new company will be eliminated. Earlier, individuals had to go through the cumbersome process of requesting a PF transfer despite having a Universal Account Number, i.e. UAN.

So let us now know what the new rules are.

Benefits Streamlining the benefit processes makes the process more efficient, thereby saving time for both employees and employers. Employees no longer need to deal with the hassle of manual requests for provident fund transfers, thus reducing the administrative burden. Automated PF With transfers, transitions between departments or jobs become seamless, thereby increasing the flexibility of the workforce. This reform promotes the financial security and well-being of employees. About Employees Provident Fund Organization, EPFO: It is a government organization that works in the organized sector in the future. Manages provident fund and pension accounts for employees engaged in.

It is run by the Ministry of Labor and Employment of the Government of India. In terms of the number of subscribers and volume of financial transactions, it is one of the largest social security organizations in the world.